Most employers are likely to find that the majority of the workers at their organisation are eligible to receive the national minimum wage. The minimum wage is payable not just to employees but to all workers who are at least of school leaving age.

Employers should note that both agency workers and those homeworkers who would not normally be categorised as “workers” are expressly covered by the national minimum wage. They should also be aware that an intern will be entitled to the minimum wage if he or she meets the definition of a worker.

There are a number of categories of worker that are exempt from the minimum wage.

- The genuinely self-employed;

- Volunteers or voluntary workers;

- Family members of the employer, living in the employer’s home and working in the family business;

- Non-family members living in the employer’s home, such as au pairs, who share in work and leisure activities and are not charged for meals or accommodation;

- Students doing work as part of their undergraduate, postgraduate or higher education course;

- Students of compulsory school age;

- People working on certain training schemes, pre-apprenticeship schemes or doing work-shadowing;

- Prisoners;

- Company directors;

- Members of the armed forces.

The rates of the national minimum wage

The rates of the national minimum wage

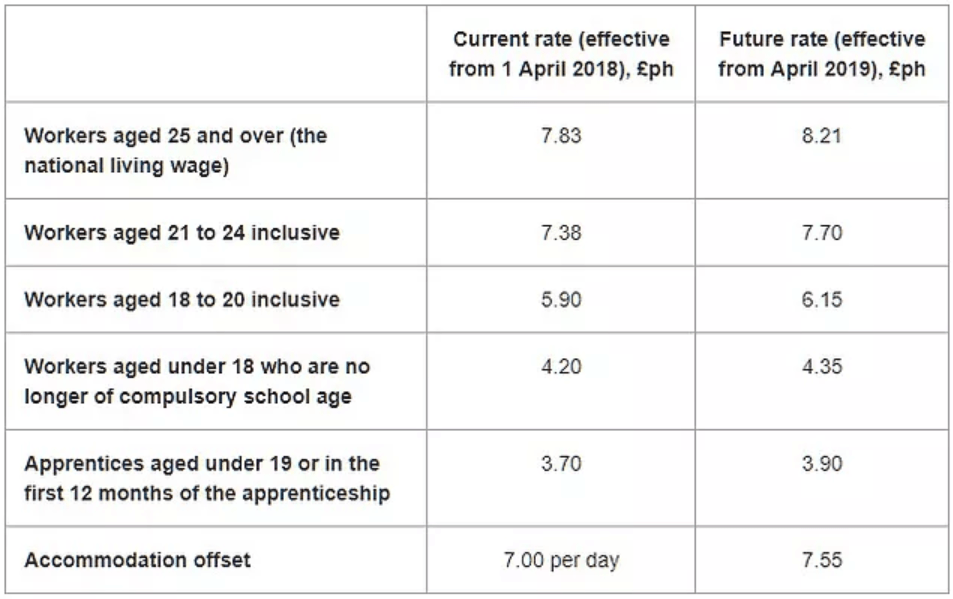

In order to check whether or not all eligible workers are being paid at or above the level of the national minimum wage, the employer must establish which workers are eligible to be covered by the different rates. A new statutory minimum wage rate for workers aged 25 and over (the national living wage) was introduced from 1 April 2016. Lower minimum wage rates will continue to apply to younger workers, and apprentices who are aged under 19 or in the first 12 months of the apprenticeship. The table below contains the current rates of the national minimum wage and the rates that will come into effect from April 2019.

Working out whether or not a worker is receiving the minimum wage

Sometimes it may not be clear whether or not a worker is being paid the minimum wage, particularly if he or she is not paid for a set number of hours each week. An employer must ensure that the payments it makes to each worker are at least equal to the national minimum wage for the hours that he or she has worked.This can be checked by calculating the gross pay that the worker has received for work done over a particular period (known as the pay reference period), then dividing it by the hours that he or she has worked during that period, as outlined below. A useful tool to check whether or not the minimum wage is being correctly paid can be found on the GOV.UK website.

We are committed to providing you with the best service possible from the high quality of our work to our outstanding customer service, we aim to put you at the heart of everything we do. We would love to hear from you, so feel free to contact us to help answer your questions.

Looking to understand more about pay rates we can carry out an HR Audit to identify any area’s that may be affecting your business?

You can contact us by filling out the secure contact form, or send us an email [email protected] or call us on 01243 607357.